A Last Will and Testament is one of the single most important documents a person can have; yet, so many of us put off dealing with it for far too long.

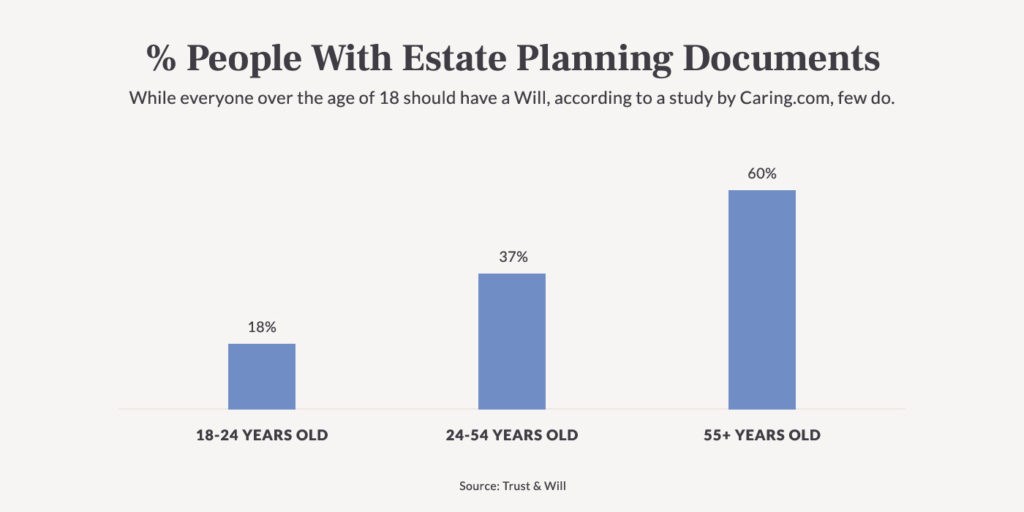

Many Americans assume that they’re “too young” to need a Will. Some people believe that they don’t own enough assets or have a big enough net worth to necessitate a Will. You might even think it’s too late to start your first Will. But Trust & Will’s mission is to explain that regardless of your age, net worth, or stage in life, having a Last Will and Testament should be a top priority. We’re here to help as many people as we can protect their families and prolong their legacies. And the best way you can do that is to create your Last Will and Testament.

That’s why we put together this comprehensive guide that breaks down everything (and we mean everything) a person needs to know about creating a proper Will and why doing so sooner rather than later is extremely important.

In this guide, we reveal the top 8 things everyone should know about Wills:

Last Will And Testament Meaning & Purpose

A Will, also known as a Last Will and Testament, is a legally prepared and bound document that states your intentions for the distribution of your assets and wealth after your death. In the event you have children, a valid Will also allows you to designate who will care for them. A Will, however, is only one part of a comprehensive Estate Plan. Curious what kind of Estate Plan is right for you? Take our short & simple Quiz to find out!

The history of Wills actually dates back to Ancient Roman times. The idea was based around the desire to provide instructions for the passing of one’s possessions to Beneficiaries. Interestingly, many of the original 19th century requirements that were established in England surrounding the creation of Last Will and Testaments have withstood the test of time, and are still legal requirements to this day in many states.

In the simplest terms, a properly-prepared Will is a legal document that ensures you’re protecting your assets, surviving spouse and heirs after you pass. By explicitly outlining what you want to have happen in the future, your final wishes will not be ignored if others try to step in.

What is the Purpose of a Will?

Everyone over the age of 18 should have a Will. Plain and simple. If you have any sort of savings, investments, property or dependents, you should absolutely take the time to create a Last Will and Testament. In the absence of a Will, assets will be distributed according to state laws and the courts. In the event you pass without a Will, typically, your spouse, children, parents or other close relatives will become the Beneficiaries of your estate.

Types of Wills

There are multiple types of Wills that are valid and legal, and the type you choose will depend on several factors, including how large or complicated your estate is.

Simple Wills

A Simple Will allows you to state your basic wishes without the inclusion of multiple stipulations or clauses. The name “simple” is somewhat misleading, though, as you can actually accomplish quite a bit with this type of Will. You can still appoint an Executor (who is charged with ensuring your wishes are appropriately adhered to). And you can also designate a guardian for any minor children or dependents.

Testamentary Trust Wills

A Testamentary Trust, also known as a “Trust Under Will” or a “Will Trust,” is written inside a Will. Similar to other Trusts, a Testamentary Trust distributes assets after you pass. However, whereas some Trusts are set up while you’re living, when a Testamentary Trust is used, the actual Trust isn’t established until after you pass. Testamentary Trusts will go through probate, and are often used in cases when beneficiaries will need to be cared for over an extended time period – examples are a dependent with special needs or young minors.

[We now offer Testamentary Trusts! Find out if it's the right plan for you– click here to learn more.]

Joint Wills

A Joint Will is similar to a Mutual Will, but a Joint Will only has one document, whereas a Mutual Will has two. Joint Wills can be useful in cases where you want your spouse to be the initial Beneficiary of your whole estate, with the final Beneficiaries being your children after you both pass. In simplest terms, a Joint Will is one Will for two people. It’s important to understand that a Joint Will becomes irrevocable (meaning it cannot be changed) after one partner passes. As long as both parties are living, changes can be made.

Online Wills

An Online Will is exactly what it sounds like. When done properly, it can absolutely offer adequate protection, and with a significantly reduced cost compared to going the more traditional Estate Planning route, face-to-face with attorneys. That said, you want to be careful if you decide to create any Estate Planning documents online. Be sure to read reviews and confirm legality and authority before you decide to rely on this option. Just like you would make sure you trust and have confidence in your attorney before hiring him or her, you want to know that you’re working with an online company that’s preparing solid, legal documents that will hold up when it counts the most.

Deathbed Wills

Perhaps the least effective and most problematic type of Will, a Deathbed Will is written when you are in a dire state, near death. Because they’re usually written during extreme circumstances, there are often a myriad of problems that result, from forgotten assets to questions about mental states.

Holographic Wills

A Holographic Will is a Will that’s written and signed by hand. While not all that common, this type of Will does still exist, generally resulting from extreme, unexpected, often life-threatening situations. Though they do occasionally surface, they’re not recognized in all states.

Nuncupative Wills

A Nuncupative Will is spoken. Like Holographic Wills, Nuncupative Wills aren’t always recognized the same way (or at all) in every state. You may need to have a certain number of witnesses, or need to have wishes written down after being spoken, or there may be other nuances.

Have questions about which type of Will is right for you? Chat with Trust & Will! We have live member support representatives who have tons of experience helping people choose the Estate Plan that’s right for them. Lucky for you, we’re just a click away. So come explore what we have to offer!

What’s Included in a Will?

While there are many different types of Wills, there are some main components that all will likely include.

Executor: When you name an Executor, you are determining who will be in charge of making sure the wishes expressed in your Will are followed. Your Executor can be your spouse, another adult family member, a close friend, a lawyer or even an adult child. You can also specify Joint Executors.

Guardianship: For parents, appointing a guardian is often one of the biggest motivations for establishing a Will. The peace of mind that comes from knowing you’ve selected the best person possible to look after your children is priceless.

Assets: A Will establishes where and how your assets or personal property go to your heirs. It gives you the opportunity to specify who gets what from your estate.

Real Property: Any building, structure or home that you own at the time of your passing is considered “real property.” Sometimes, it makes sense to create a Trust that owns any real property.

Final Arrangements Instructions: Specifying funeral arrangements and your wishes for your remains is a big part of your Estate Planning.

Differences between a Will and a Trust

There is one major difference between a Will and a Trust. A Trust takes effect as soon as it’s created and signed, but a Will does so after you pass away. There are some other differences as well, including:

Wills require probate in order to transfer items to designated beneficiaries, whereas Trusts (both irrevocable and revocable) can avoid this.

Wills are public record while Trusts remain private.

Wills only take effect after your passing, but because a Trust is immediately effective, it can provide direction while you’re alive in the event you become unable to make decisions on your own.

How Much does a Will Cost?

Obviously there can be significant cost differences depending on how you go about taking the important step of setting up and finalizing your Will.

One option — and yes, we may be biased — is to become a member of Trust & Will. Our Will-based Estate Plan starts at just $199 (plus you can add your spouse for an additional $100) and allows users to make unlimited updates for 30 days. After that, it’s just $19 every year to store your Will and make changes as necessary. You won’t find a more affordable option that’s backed by attorneys and comes with best-in-class member support. Trust & Will is different from other online Estate Planning companies – with plans that are customized for your exact needs, in the state you reside in, we eliminate the issues that too often result from one-size-fits-all plans.

The most expensive route is the traditional one, where you meet face-to-face with a lawyer, usually multiple times, to discuss and put your plan into action.

The final option is the free online route, where you can find a site that offers Will and Trust Planning all online, for free. There are multiple obvious concerns with the free path, but topping the list is the potential for inconsistencies in the types of documents available, boilerplate forms and fill-in-the-blank documents that may or may not be legal in your state.

Steps for Creating a Will

Regardless of which route you take to create your Will, there are some basic steps you want to take to ensure you’re covering everything you need, so your final wishes will be known and adhered to.

Take inventory of your assets. Everything from your home to your personal items — and don't forget about digital assets!

Choose your Beneficiaries. Decide which items you want to distribute to which people.

Select an Executor. Choose your person and notify them of your choice.

Decide on who you will appoint as guardian if you have children. This step is only necessary if you have minor children or grandchildren.

Be explicit. It's important to be extremely specific about how your assets will be passed down so that your final wishes are carried out appropriately.

Make your will online if you decide to forego the traditional attorney route. You have many options here, so it’s important to find someone trustworthy. Look for a partner who understands the nuances and complexities of Estate Planning. Trust & Will is built upon the foundation of an experienced, knowledgeable legal team. We also offer a 30-day satisfaction guarantee. And the biggest difference between Trust & Will and some of “those other guys”? We have an expert team, available to you, if you have questions or need help. Don’t believe us? Reach out today!! You’ll reach a real human being.

Sign and notarize your Will. Two witnesses are required in most states, but there are some, such as Vermont, that require more.

Put your Will in a safe place. A fireproof safe is the best option. Some people opt to use a safe deposit box at a bank, but there is a downside to this – it can be difficult to access safe deposit boxes after an owner dies.

Make updates to your Will. This should happen periodically as needed but recommended to do so every 3 to 5 years or after important life events.

Other Common Questions about Wills

Do I Need An Attorney to Write a Will?

You do not need an attorney to write your Will. While some people may feel more comfortable with the expert advice a lawyer can offer, keep in mind there are more ways to gain this confidence than solely going the traditional route.

Can You Write Your Own Will?

There is no law or rule against writing your own Will, but the likelihood of you crafting something that’s legally sound, effective and conclusive is very low. There are also requirements that vary by state, and not adequately meeting them could potentially result in a Will that’s not valid.

What Happens If You Don’t Have a Will?

If you do not have a Will when you pass away, it means you’ve died “Intestate.” Under these circumstances, individual state laws will then dictate the distribution of your estate.

What Should You Not Put in Your Will?

There are certain things you can’t or shouldn’t put in your Will. For example, a Will shouldn’t have:

Property that’s jointly held

Funeral plans (Though Final Arrangement plans can be put in a Will, there is some debate about this. If you choose to include your wishes for your funeral plans in your Will, it’s advisable to also put them somewhere else, as sometimes plans left solely in a Will may be found too late.)

Life insurance (You will have designated a Beneficiary on individual life insurance policies.)

Retirement funds (Similar to life insurance, you should designate a Beneficiary who will receive your retirement funds upon your passing.)

Digital estate items (The advent of technology has introduced a new concept in Estate Planning: the idea of a “digital estate,” which includes things you’ve purchased digitally, like your cloud-based accounts, iTunes purchases, eBooks, videos, etc. While these can’t effectively be put in a Will, you can note a “Digital Executor,” who will have expressed authority to handle your digital accounts)

What is the Difference Between a Will and a Living Will?

You may have heard of a Living Will, which is sometimes also called an Advance Healthcare Directive. But what is a Living Will? How is it different from a regular Will? A Living Will is created while you’re alive and sound. Its main purpose is to direct what should happen if you’re in a state where you’re suddenly unable to make your wishes known for your end-of-life care. Living Wills have no power after you pass.

Should My Spouse and I Have Our Own Wills?

Most married couples and partners today set up individual Wills. While Joint Wills do exist, there are some major downsides, and few benefits to going this route.

How Often Should I Update My Will?

While there is no set date or timeline for when you should update your Will, a good rule of thumb is this: any time you have what’s considered a “major life event,” you should look at your Will. Life events can include:

The birth of a child

Death of anyone related to the will

Marriage or divorce

Change in ownership of major property

Moving to a new state or country

Even if you have no major life events, it is a good idea to review your Will occasionally. Usually every 3 - 5 years will suffice.

What Is the Difference Between a Testator and an Executor?

A Testator is the person who the Will is written for (you). When the Testator passes, the Will dictates his or her wishes. An Executor is the person appointed by the Testator who administers the Will upon the Testator’s passing.

Can My Will Be Contested?

If you have a solid, well-planned Will, it can only be contested for very specific, defined legal reasons, such as:

Concern the Testator was mentally unstable or incapacitated at the time of signing

The Testator was under the influence when signing

Questions about the manner in which the Will was signed and witnessed – individual states may require different numbers of witnesses

Suspicion of fraud, undue influence, duress or coercion

Where Should I Keep My Will?

Wherever you keep your Will, be sure it’s in a safe place. Some choose to give it directly to their appointed Executor, who should then ideally keep it in a fireproof personal safe.

Planning for the future is not only smart, it’s also the only way to control your legacy, protect your family, and gain peace of mind. When you can feel confident that your final wishes have been explicitly stated and can therefore trust that those wishes will be executed exactly the way you envisioned, it is empowering beyond belief.

There is no better day than today to take control of your future by making the decision to create your Last Will and Testament with Trust & Will. Discover which option is best for you!

Share this article