How To Apply For an EIN For Probate

Follow our easy step by step instructions to apply for an EIN tax ID number for Probate needs in just a matter of minutes.

By Maya Powers

Estate Planning Content Expert, Trust & Will

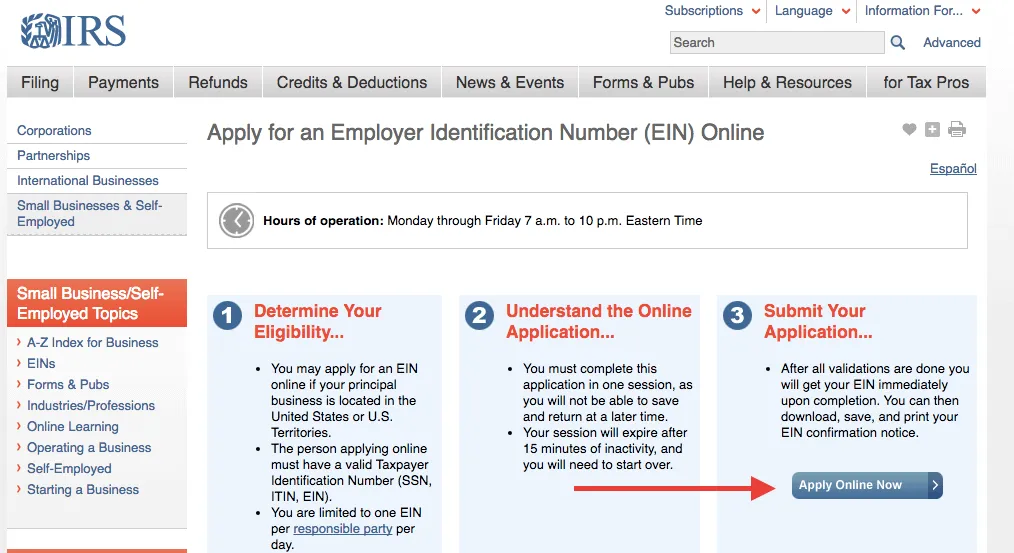

1. Go to: Apply for an Employer Identification Number (EIN) Online and click on the “Apply Online Now” button

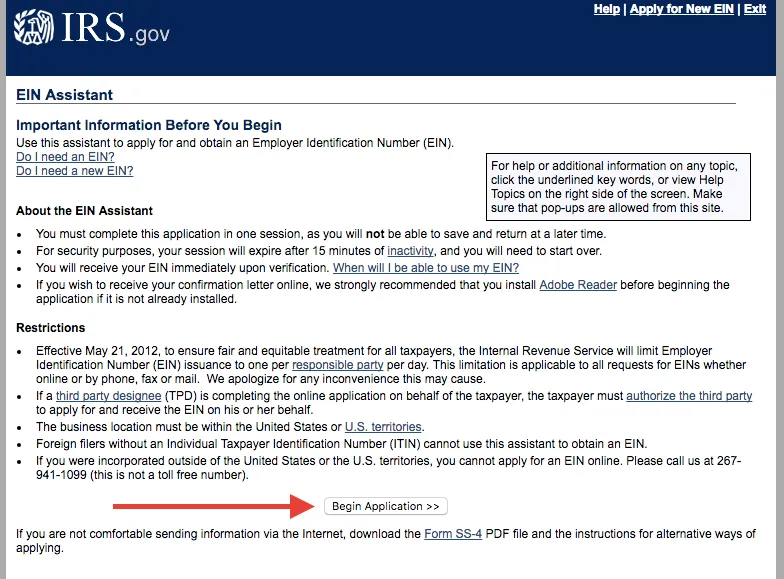

2. Click on the “Begin Application” button

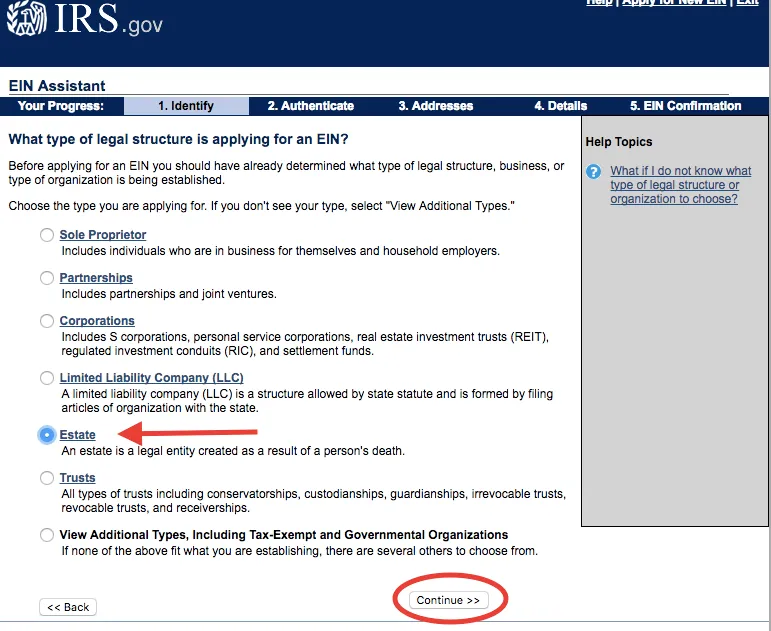

3. Select “Estate”

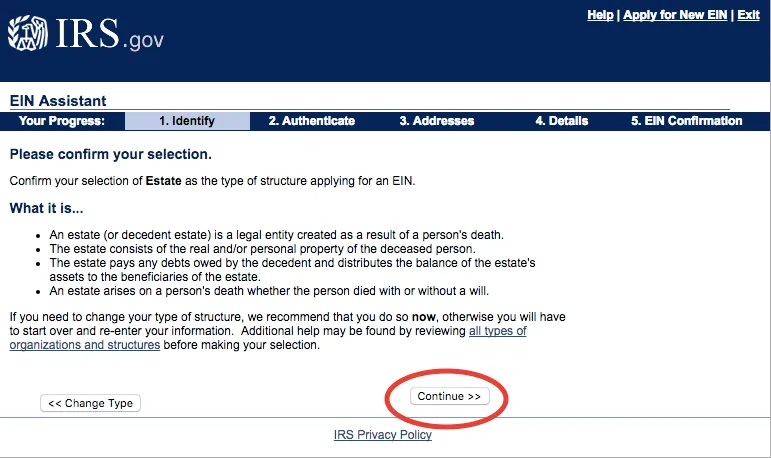

4. Confirm that you want to create a tax id for an estate

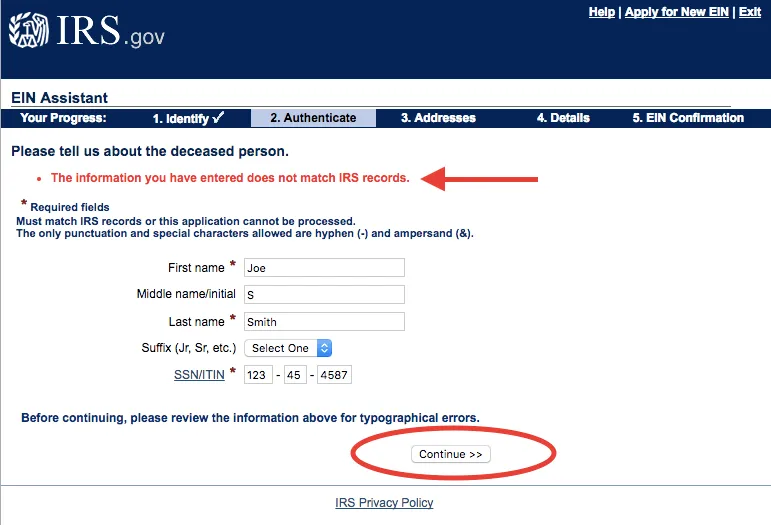

5. Enter information about the deceased. Make sure to enter the correct social security and legal name as the IRS will match with its database

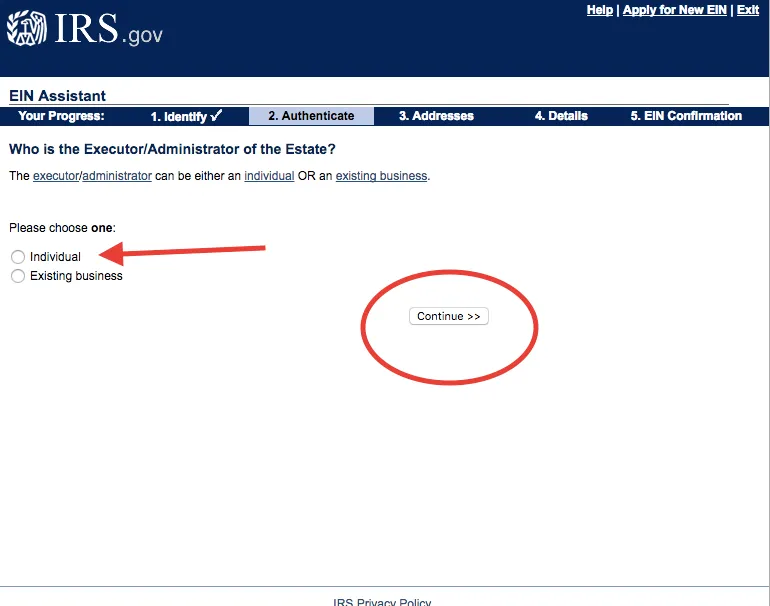

6. Select the type of executor/administrator. If you are an individual person, select the individual (most common). If you are an entity (business that helps with the estate process, like a bank or trust company) select an entity

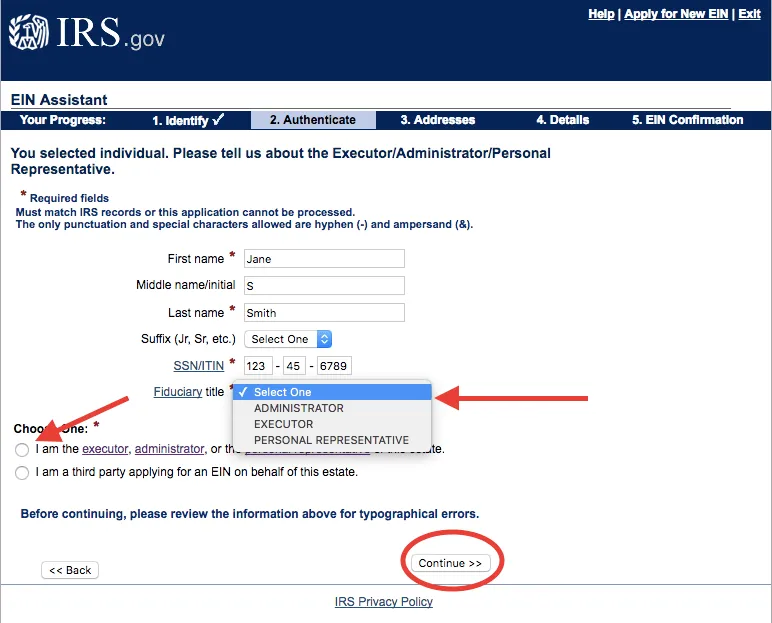

7. Enter the official court representative information. You will need to designate whether you are an Administrator (no will), Executor (ix) (valid will), or Personal Representative (special circumstance, ex: no valid executor can serve). Select whether you are applying yourself as a court appointed representative. Only select a third party if in fact you are a third party applying for the executor/administrator

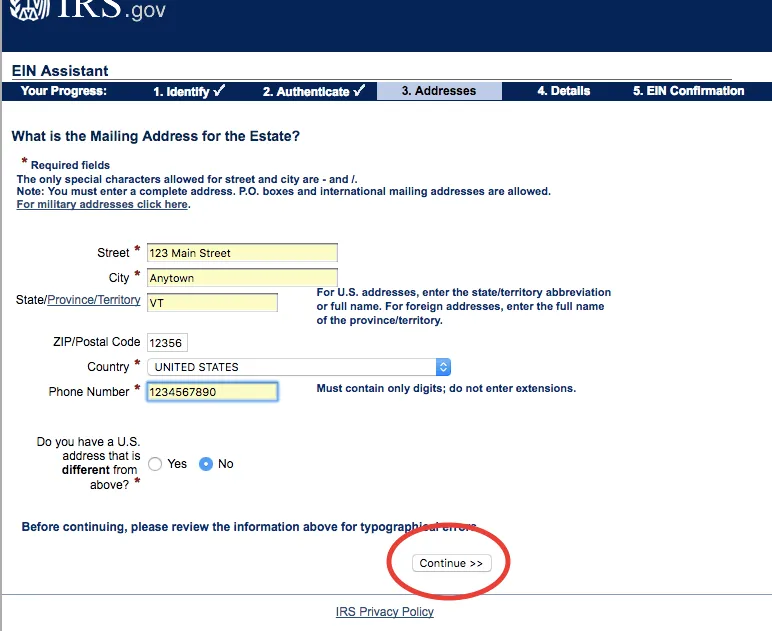

8. Enter the executor/administrator address, this will serve as estate mailing address

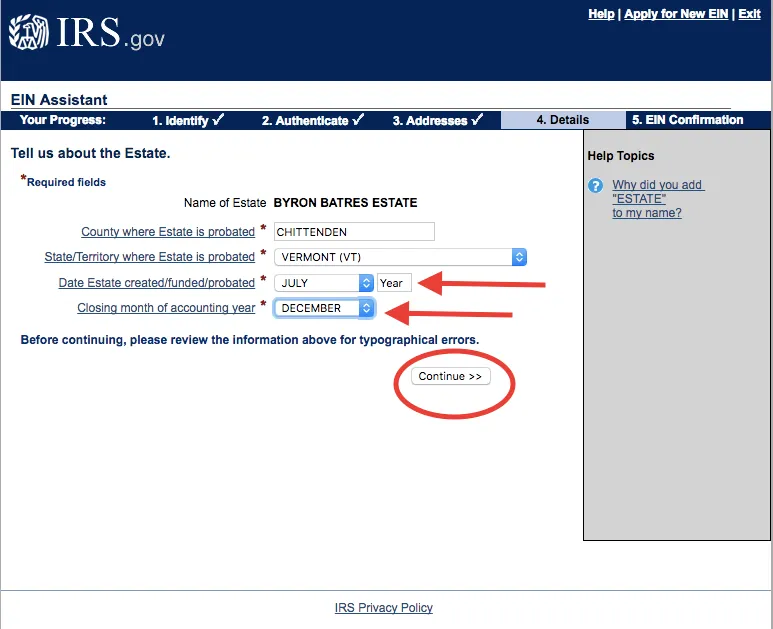

9. Note that estate has been added to the name of the deceased. Verify the pre-filled information (county, state) and enter when the probate was funded (enter date of court appointment). Choose your month end accounting (month that will mark your taxable reporting period). You can choose to enter any month here, it is recommended you choose either calendar year end or the month of death. Most choose the calendar year as all tax reporting from financial institutions will be the calendar year end.

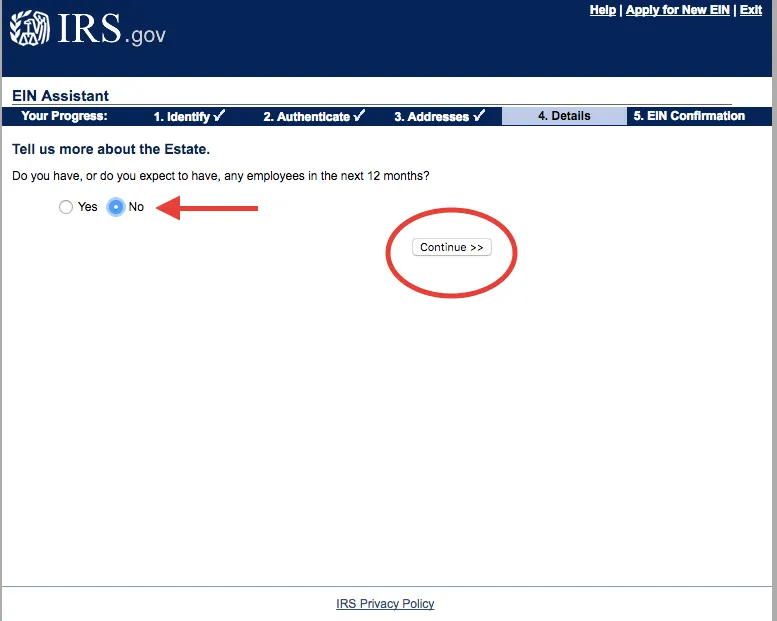

9. Select “No” for the employee question

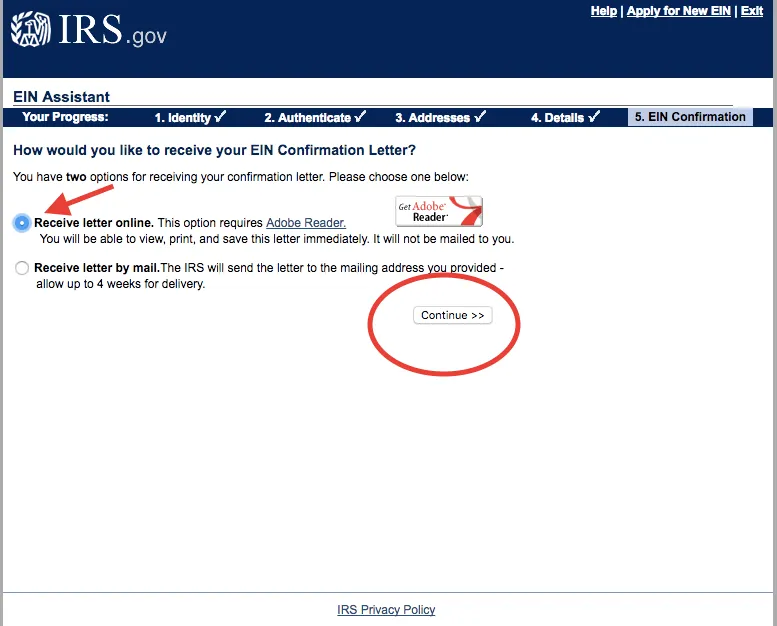

10. Select receive letter online. Confirm your information and you will get a PDF with the Tax ID. This will instantly provide you with the IRS letter with the Tax ID for the estate. Make sure you print and save the PDF.

Related Topic

Last updated: March 21, 2025