End of Life Planning: A Complete Guide for Navigating a Difficult Time

Talking about end of life planning is never easy. But when you’re prepared, the conversation will be more bearable. And we're here to help you navigate!

By Staff Writer

Trust & Will

End of life planning is important, but that doesn’t mean it’s always easy. From a pragmatic standpoint, the idea of preparing for the end simply means you’re easing what could one day be a very heavy burden on your loved ones. The assurance an Estate Plan offers you, your loved ones and the legacy you’ll leave behind is worth more than you may realize. While simply having a Will may not be enough, a complete, comprehensive Estate Plan (like the one you can quickly and easily create with Trust & Will) that includes your end of life wishes can protect your family and safeguard your legacy.

Have questions about what you need to do and how you should go about creating your end of life plan? Read on, as we’ll cover everything you need to know in our comprehensive end of life planning guide, including:

What is end of life planning?

End of life planning is the part of your Estate Plan that formalizes and makes known your wishes about what you want to have happen when you’re reaching the last phase of your life. So often, we’re unable to adequately express what we want when we reach this point. Thus, we place an unintentional but incredible burden on our loved ones as they become faced with making tough decisions and choices that nobody wants to for those they love.

Your end of life plan includes things like your end of life care preferences, as well as how extensive medical interventions and measures taken should be. And though it can feel uncomfortable to prepare, just like other parts of your Estate Plan, you may even feel a sense of peace once you put an end of life plan into place. It ensures your wishes are clear, so that your family and loved ones won’t be faced with the difficult task of making decisions on your behalf. That, on its own, makes end of life planning worth it, regardless of how arduous the task may seem. Think of it as one of the last gifts you leave your loved ones.

Why is end of life planning important?

End of life planning is important so that your wishes can be made official. But there’s a bigger piece here that we don’t often talk about. Really, this part of your Estate Plan has a lot more to do with others in your life than it does with you. The end stages of life leave those closest to you fraught with many difficult-to-navigate emotions. They’ll of course be sad, perhaps confused, often angry, and it’s not uncommon for different family members to have widely differing beliefs about what would be best, both at the end, and even after, you pass.

Preparing now for the inevitable means you can relieve some of the stress your loved ones will feel while protecting your assets and legacy. It means you can take control of the dying process while you’re still able. Particularly if you’ve been faced with a recent diagnosis of a terminal illness, establishing future decisions now can offer some semblance of control in what will likely feel like a very out of control environment.

In addition to having an Estate Plan in place, there are great services to help you plan your end of life wishes or manage the death of a loved one, like Lantern. Check out their helpful guides, checklists, and resources to ease your stress and help you along the way.

How to improve the end of life planning conversation

Having a conversation about your end of life plan with your friends and loved ones will probably be hard, but it’s an important part of the process. It becomes even more essential (and perhaps pressing) if you’re facing a recent diagnosis.

Planning what you’ll say and having a clear idea of how you’ll conduct the discussion can be beneficial and help you get through it. There are also There are several steps you can take to make it easier to broach the subject of your end of life wishes with those around you.

Engage completely. Make direct eye contact, remain compassionate but firm.

Remain matter-of-fact. Keep the conversation high level and very fact-based. Think of it as if you’re talking about allergies or another common ailment.

Encourage respect. Let family and friends know you’re expecting a lot from them - so that they respect your wishes. Also consider encouraging end-of-life companionship opportunities.

Ensure your own understanding. Often, families will need assurance that you fully understand what you’re asking. Be patient and reassure them that you’re of sound mind and have put thought into your decisions.

Give them time. Keep in mind that even if you’ve come to terms with the future, your loved ones may need some time. That’s OK...try to give it to them.

It’s not uncommon for families to have a difficult time accepting the information you’re offering them. If you’re finding this true, there are a few things you can do to help.

Bring them to your next appointment. Your doctor can help you set expectations for what your future may look like, and this may be a key factor in the ability to accept your decisions.

Put your plan in writing. But don’t stop there - talk, a lot, to your loved ones. While it may seem and feel fiercely otherwise, remember (and remind them) that death is actually one of the most normal parts of life. The more you try to normalize it, the better the chance your loved ones will be able to come to terms with what you’re facing. Keep in mind, this does not always mean it will be easy, but it can help as they move through the grief process in their own way.

Check in often. Expressing your end of life plan typically isn’t a one-time thing. Check in along the way. Let them know you understand how difficult this must be for them.

Remember that things change, and that’s OK. Even the best plans can be subject to changes beyond our control. Let your family know that even if things don’t go exactly as you plan, you’re trying to trust the process.

Ultimate end of life planning checklist

Once you understand why end of life planning and care is so important, and you have a plan in place to communicate with your loved ones, you can take comfort in the fact that you know you’ve done everything you can on your end.

Use the following checklist to ensure you have a plan that’s on point and complete.

Prepare your end of life planning documents

Decide between a Will or Trust

Make a list of your assets

Determine end of life housing plans

Write down your final wishes including funeral plans and burial arrangements

Create an obituary and/or death notice

1. Prepare your end of life planning documents

It’s not uncommon to feel a bit overwhelmed as you begin this aspect of your Estate Plan. But once you start the process, you’ll see it’s not all that complicated. Knowing what you need ahead of time can help, as you’ll feel confident when you have a course of action to follow. You may need some of the following documents:

Living Trust: Lets you manage your estate and assets while you’re living and after you pass away.

Living Will: Ensures your wishes about medical decisions will be followed in the event you become incapacitated and are unable to express them on your own.

Last Will and Testament: Written legal document that details how your assets should be handled and what happens to any dependents after you pass.

POAs: Healthcare POA/Durable Medical POA/Healthcare Proxy/Durable POA for Finances: Power of Attorney documents can vary in scope and authority but will appoint or designate someone to make legal, financial, medical or business decisions on your behalf in the event you can no longer do so on your own.

Organ/Tissue Donor Designation: Documents any donations of tissue or organs you would like to allow upon your death.

Domestic Partnership Agreement (if applicable): Used to declare legal rights and responsibilities for long-term partnerships.

2. Decide between a will or trust

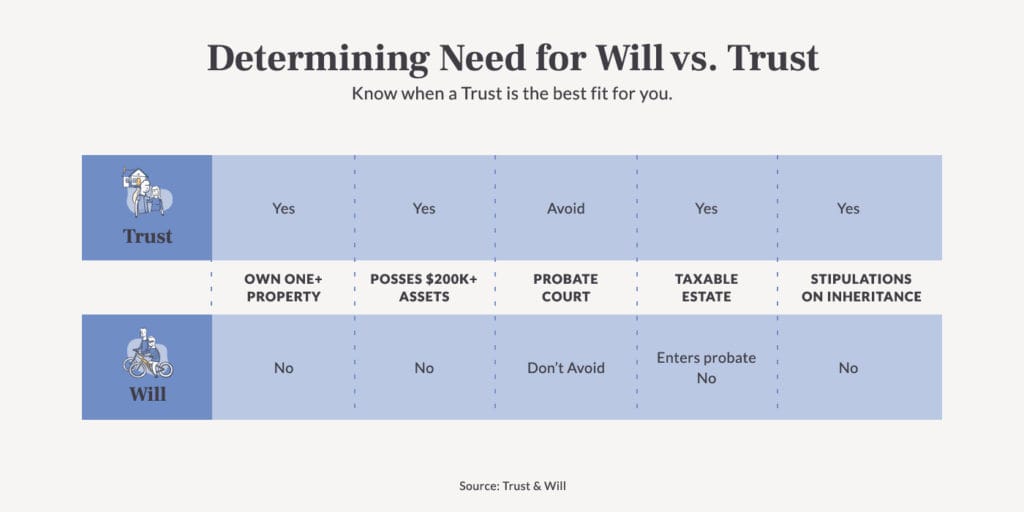

There is a common misconception that Trusts are only for the very wealthy. But the reality is, anyone who owns property or assets worth $160k or above should consider a Trust. Not only do Trusts protect you, your loved ones and your legacy once you’re gone, they also offer privacy. And, when your estate is held in a Trust, your loved ones will avoid the costly, often painful and messy public process of probate.

Trust & Will now offers probate help. Learn more about our different plan option, today.

Keep in mind, even if you’re not quite ready to create your Trust right now, a Will can be a good start. Create a Will quickly, safely and cost-effectively using a trusted online service like Trust & Will. And if you do pursue this route, you can always easily upgrade to a Trust at any time. Trust & Will even applies the cost of creating your Will toward your Trust if you decide to take that next step!

Not sure which path is the best one to take? The easiest way to think about a Will vs Trust is that Wills tend to be the simpler route, whereas Trusts can be a bit more complex. A key difference between the two is a Will isn’t effective until after you pass away, and a Trust goes into effect as soon as you create and fund it.

Use a Will to:

Name guardians

Plan for your final arrangements

State how you want your assets passed down

Your Trust is a living document that essentially owns and holds your assets. Trusts are good for:

Stronger control over asset distribution

Privacy (Wills go through probate, the process by which the court distributes your estate per your instructions; they are public information, whereas a Trust is private)

Protection (since your Trust technically owns your assets, your estate will be protected from litigation)

3. List your assets

Assets are what you own and will pass down to your heirs. A list of assets can widely vary depending on what you’ve accumulated throughout your life. The following list is an example of the types of assets you might include in your Estate Plan.

Savings/Checking Accounts

Cash/CDs/Treasury Bills

Real Estate/Land

Investments/Stocks/Bonds

Pensions/Retirement Plans

Life Insurance Policies

Art/Collectibles

Jewelry

Corporate Assets

4. Determine end of life housing

If you’re at the point where you need to start thinking about end of life housing, a few tips can help you move through the process. The first thing to determine is what type of housing you anticipate needing. This will be key in deciding on what questions to ask and what you’ll want to be thinking about. You may need an assisted living facility, a nursing home or in-home care.

If you think you’ll be transitioning into an assisted living facility, you’ll want to consider the layout and amenities, the services available and what level of medical care is offered. Touring a facility can help you get a feel for things like how friendly and warm the staff is, what the culture of other residents seems to be and how the meals will appeal to you.

If you think a nursing home is the next probable step for you, you’ll want to ensure the facility you choose is a good fit for your needs now and into the future. A nursing home will be one step up from an assisted living facility in that they generally offer round the clock, more intensive care. Think about the layout of the building or buildings, how many nursing stations there are, if there are common rooms for activities and what patients’ rooms look like (do you want a window? A TV?).

In-home care will likely be a very different experience, and you’ll want to be in tune with how comfortable you are with the caregiver who will be in your home. Finding the right fit may be more important in this scenario than any other.

5. Decide on funeral and burial arrangements

Though it can seem morbid, making plans for your funeral and burial arrangements ahead of time is one of the kindest things you can do for your loved ones. Grief can grip us in many ways, and sometimes it takes all we have to just get through the day after we lose someone we love. Being forced to make decisions about how to say goodbye and all that goes into planning a funeral and burial can just be too much. You can ease that burden, even if it’s just by a little bit, when you make some of the plans ahead of time. Think about your religious beliefs and your final wishes, and then plan for how you want your loved ones to say goodbye to you.

There are several types of funerals:

Traditional Service: Also known as a full funeral service, traditional services usually take place in a church or funeral home.

Viewing and Visitation: Typically involves an open casket during a set time period for visitation.

Wake: Often a gathering at a home, usually before a more formal service.

Memorial Service: Generally a service that happens after a burial or cremation.

Celebration of Life: A service that allows for loved ones to pay tribute to the deceased in a personal way.

Committal or Graveside Service: Usually brief, a committal or graveside service may occur after a funeral and will oftentimes include prayers and flowers.

Scattering of Ashes Ceremony: Common after cremation, the scattering of ashes can occur at a place or places special to the deceased.

In addition to funerals, there are also several options for types of burials:

In-Ground: In a cemetery, one of the traditional choices for laying a loved one to rest.

Above Ground (Public or Private Mausoleum): Another option for final resting is placing the body or ashes in a mausoleum, a structure used for entombment.

Above Ground (Lawn Crypt): Like a mausoleum, lawn crypts are an above-ground space that’s enclosed and can be for one or two people.

Cremation: The process of disposing a body by reducing it to chemical components through combustion (burning).

Natural Burial: Becoming increasingly popular in recent years, natural burials allow the body to decompose and naturally recycle into the earth.

Burial at Sea: Disposing of a body or ashes from a boat, burials at sea are common for the Navy and veterans as well as private citizens.

6. Create Obituary and Death Notice

Many times, an obituary is written after a death, but it doesn’t necessarily have to be left until then. Some people opt to write their obituary and death notice on their own, and others choose to simply have a conversation with a trusted friend or family member, letting them know what they would like included when the time comes.

A death notice will usually include basic information like a full name (and maiden name, if desired) and a nickname (if one was used). It can also have the date and place of the death, surviving family members’ names and details of any service or funeral. Cause of death is sometimes (but not always) included, and it’s common to add the names of charities or places where donations can be made to honor the deceased.

Facing mortality is difficult for a lot of us, but thinking practically about it, with a clear mind and a list of helpful information to guide you, can ease the discomfort and help you navigate the process. While death is often a sad, uncomfortable time, those left grieving can be comforted with the knowledge that you prepared in your own way, making your wishes known and planning as much as you could to help them through their loss.

Equipping yourself with proper end of life planning tools, like our helpful checklist, will make preparing for that inevitable part of life just a little bit easier. Here at Trust & Will our simple process designed by attorneys is trusted by thousands of people just like you. Don’t put off your end of life planning another day. Instead, get started with Trust & Will by taking our quick quiz to help determine the kind of Estate Plan that’s right for you!

This message contains marketing content and affiliate links to products or services. Trust & Will may receive commissions for purchases made through these links.

Last updated: March 21, 2025