Community Property States & Definition

Curious if you live in a community property state? Our helpful map of community property states and full guide will tell you in no time. Check it out.

By Craig Parker

Assistant General Counsel, Trust & Will

Knowing whether or not you live in a community property state is more important than you may think. While there are only nine community property states in the country, they actually make up a whopping 25 percent of the United States’ total population. That means there’s a pretty good chance community property laws might have some effect on your life.

Wondering whether or not community property laws can affect you? Read on to learn:

What is Community Property?

Community property is defined as essentially everything that spouses own together. In essence, it’s anything that’s acquired during a marriage. A community property state determines all property, earnings (and debts!) that are accumulated during a marriage are equal amongst two people. Not all states recognize community property, and the specifics vary a little in the states that do.

Examples of Assets Considered Community Property

With community property, each spouse has an ownership interest in virtually every piece of property that’s been purchased or otherwise gained or earned during a marriage. Keep in mind, this can be true even if only one spouse's name is on a property’s title, and regardless of whether just one, or both, spouses are working to bring in income. The most common types of community property include:

Income: Earned income is one of the most common examples of community property.

Assets purchased with income: If community property income is used to purchase other assets, those then are considered community property.

A residence: Your home, if purchased during a marriage, is another example of community property, even if only one spouse’s name is listed on the title.

Rent or property profits: If property was purchased with community property earnings and is bringing in rent or other profits, that money is community property.

Debts: Debts owed from purchases during a marriage would be split equally upon divorce.

Settlements or damages won: Damages or settlements awarded or earned from certain lawsuits would likely be community property.

How Does it Impact My Estate Plan?

Where you live, whether or not you’re in a community property state could have a significant impact on your Will or Trust. It’s critical your Estate Plan takes any community property laws into account. For example:

If you live in a community property state, you can’t have an individual Trust if you’re married.

It’s also important to note, upon your passing in a community property state, you’re required to leave 50 percent of your estate to your spouse, although you can usually pass on your half to whomever you wish.

Some community property states let you add a “Right of Survivorship,” which allows for the deceased spouse’s portion to pass through to a surviving spouse while avoiding probate.

Other community property states do require probate.

Trust & Will now offers probate help. Learn more about our different plan option, today.

List of Community Property States

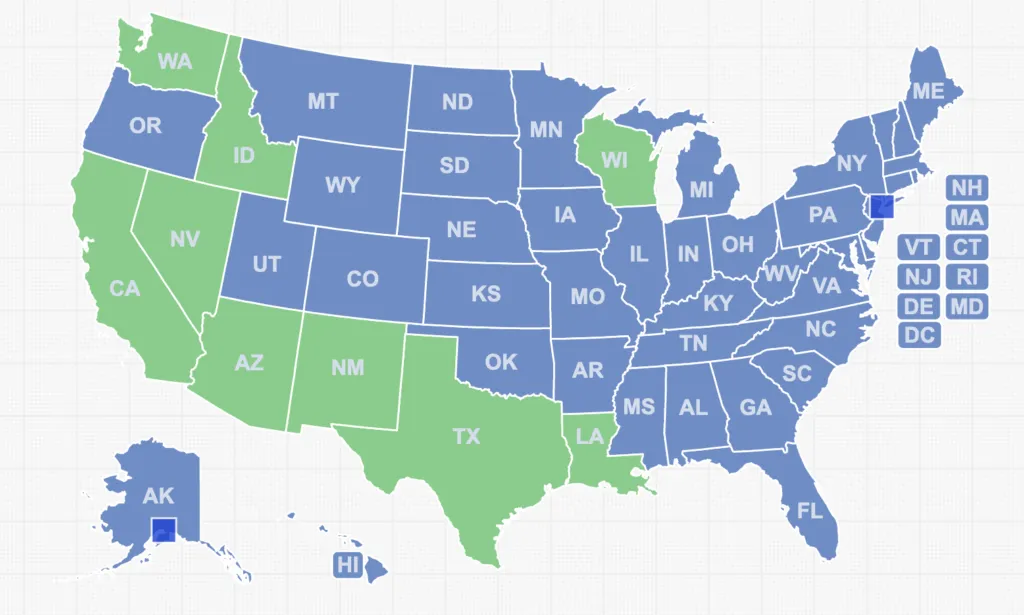

*Community property states in green

Only nine states in the country follow community property laws. These states include:

Arizona

*California

Idaho

Louisiana

*Nevada

New Mexico

Texas

*Washington

Wisconsin

In addition to the above states, Alaska is considered an “opt-in” state. There, couples can agree to a division of property based on community property law, even though the state as a whole isn’t technically legally a community property state.

*States that consider registered domestic partners as subject to community property laws.

Other common questions

Why Does Community Property Matter to Me?

For the most part, spouses don’t notice much difference between community property and other types of property. However, there can be important differences at death.

How Do I Know If Something is Community Property?

There are many complex rules for determining whether something is community property or not. If you have concerns about what is considered community property, even if you don’t live in a community property state, you might wish to consult an attorney for more information.

What Happens If I Get a Divorce in a Community Property State?

If you live in a community property state and you get a divorce, everything you own that was acquired during the years you were married, from property to income to assets, will be split equally.

Are Inheritances Considered Community Property?

Inheritances can be considered “separate property,” even in a community property state, as long as the funds or property stay separate and do not go into a joint bank account, etc.

Is My Retirement and Pension Community Property?

Like all other assets, your retirement funds and any pension you earn will be considered community property, and the amount contributed and accrued during the marriage will be split equally.

What ISN’T Community Property?

Several things can remain separate property, even if you live in one of the community property states. These can include:

Property purchased prior to a marriage (that doesn’t have both spouses’ names on a deed or title).

Property earned from an inheritance or gift (as long as it doesn’t go into a joint account).

Property purchased after you are legally separated.

Debts that were acquired before marriage.

Do We HAVE to Split Everything 50/50 If We Live in a Community Property State?

No, you can mutually agree to divide assets however you wish, regardless of where you live, even if it’s in a community property state.

Is My Prenup Valid in a Community Property State?

Prenuptial agreements can override community property laws.

It’s important to understand both the meaning, and the consequences, of community property laws. Particularly when it comes to Estate Planning, you want to be sure you fully grasp the implications of how property will be passed down upon either spouse’s passing. Trust & Will designs state-specific Estate Planning documents, created by legal experts, while considering the impacts of living in a community property state.

Related Topics

Last updated: June 12, 2025