Trust & Will vs. Guardian Reviews: Which Estate Planning Platform Is Right for You?

Compare Trust & Will vs. Guardian to see how the two estate planning platforms differ. Learn what Guardian reviews don’t always cover—and why many families and financial institutions choose Trust & Will.

By Staff Writer

Trust & Will

Estate planning is an essential part of financial wellness, but not all estate planning options are built the same way. If you’re researching solutions through an employer benefit or on your own, you may come across Trust & Will and Guardian.

While both offer access to estate planning tools, their approaches—and the depth of support they provide—are fundamentally different. Below, we compare Trust & Will and Guardian’s will preparation offering to help you determine which solution best fits your needs.

Overview: What Each Platform Offers

Guardian is a long-standing insurance and benefits provider. Estate planning is offered as part of Guardian’s Employee Assistance Program (EAP) through a third-party vendor. This will preparation service is included as a benefit for employees who already have Guardian insurance coverage, but it is not Guardian’s core product.

Trust & Will is a purpose-built estate planning and settlement platform designed specifically for creating wills, trusts, and related documents. We offer attorney-backed, state-specific estate plans through a modern online experience—along with turnkey, co-branded programs for employers, financial institutions, and other organizations.

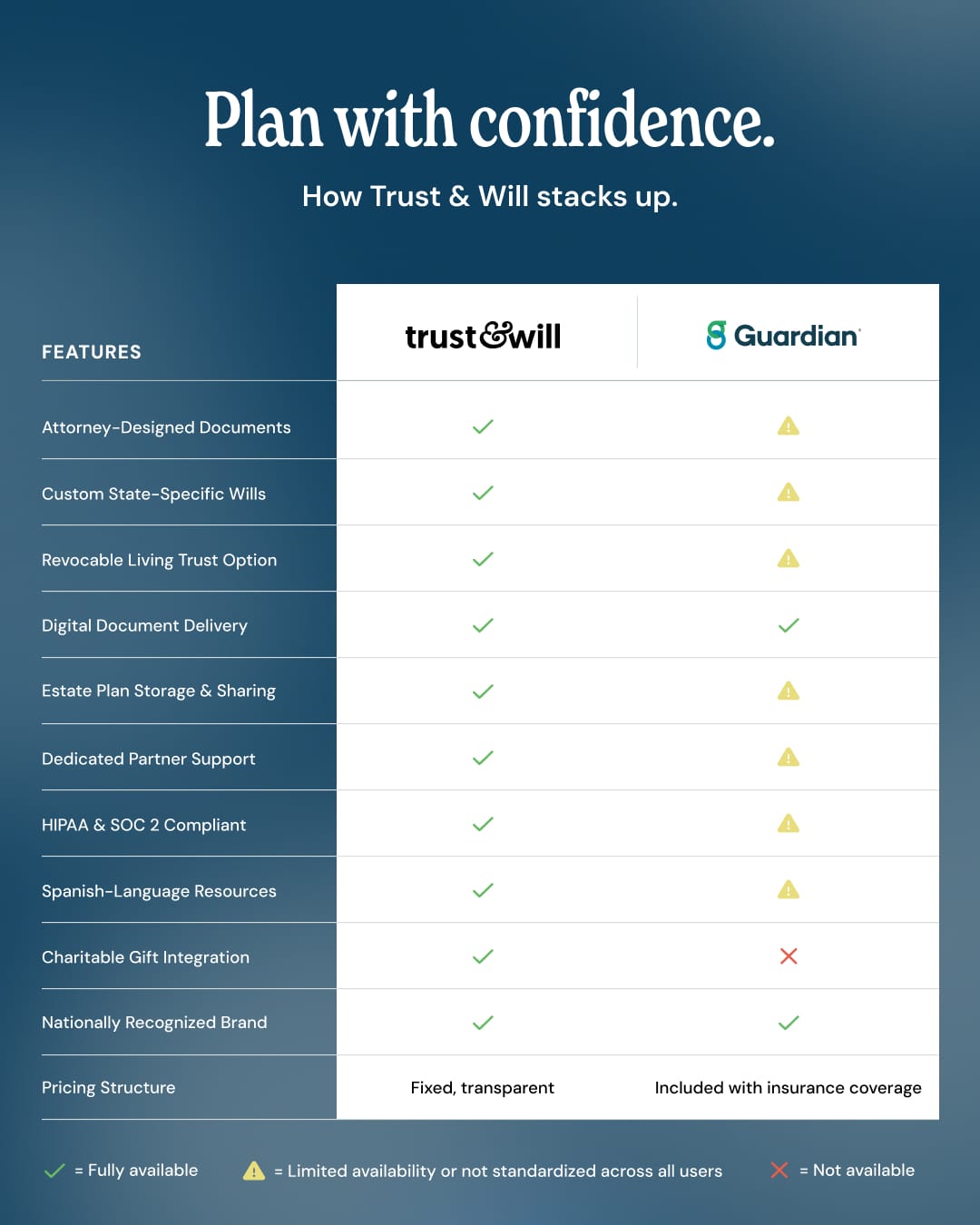

Key Differences at a Glance

Although both options provide access to estate planning documents, the scope, experience, and level of support vary widely.

Pricing & Access

Trust & Will offers transparent, one-time pricing: $199 for a Will Plan, $499 for a Trust Plan, with optional Attorney Support ($299).

Guardian’s will prep is included at no additional cost for employees enrolled in qualifying Guardian insurance or EAP programs; it is not available as a standalone offering.

Business Model & Availability

Trust & Will operates a B2B2C and direct-to-consumer hybrid model, allowing organizations to offer a fully branded estate planning benefit with measurable engagement.

Guardian’s will prep is bundled into broader EAP coverage, with no co-branding or employer customization and limited reporting.

Estate Planning Features

Trust & Will provides wills, trusts, powers of attorney, HIPAA authorizations, healthcare directives, and young adult plans—all tailored to state laws.

Guardian’s offering includes basic wills, POAs, healthcare directives, and trust templates, typically in a more limited, generic format.

Legal Oversight & Compliance

Trust & Will documents are attorney-vetted, maintained for all 50 states, and supported by an internal legal team, with optional attorney review available.

Guardian’s will prep relies on template-based documents and time-limited phone consultations, with legal specificity and ongoing updates less emphasized.

User Experience

Trust & Will delivers a guided, modern, mobile-friendly experience refined by feedback from over 1 million users, with free printed documents mailed to members.

Guardian’s will prep provides a more static web portal, where users typically download and print documents themselves.

Support & Ongoing Help

Trust & Will offers dedicated Member Support via chat, phone, and email, plus optional attorney guidance and partner success teams.

Guardian’s will prep is supported through a general EAP help line, with estate planning assistance limited in scope.

Security & Reporting

Trust & Will is SOC 2 certified, uses AES-256 encryption, and provides partners with monthly usage and engagement reporting.

Guardian’s will prep assumes security through its vendor relationship, but does not publicly disclose certifications or estate-specific reporting metrics.

Why Families and Organizations Choose Trust & Will

1. Estate Planning Is the Core Product

Trust & Will is purpose-built for estate planning—not a side benefit. Every feature, document, and workflow is designed to help individuals create legally sound plans with confidence.

2. State-Specific, Attorney-Backed Documents

Our documents are customized to state laws and maintained by legal experts, reducing the risk of outdated or overly generic plans.

3. Designed for Engagement, Not Just Access

Trust & Will supports meaningful adoption through modern UX, educational resources, lifecycle triggers, and branded campaigns—driving far higher engagement than typical EAP benefits.

4. Proven Trust and Scale

With 1M+ users, 6,000+ reviews, and a 4.8★ Trustpilot rating, Trust & Will delivers a level of credibility and impact that bundled benefits simply can’t replicate.

The Bottom Line

We hope these Trust & Will vs. Guardian reviews helped clarify the differences between the two options. Guardian’s will prep benefit can be a helpful, no-cost add-on for employees already enrolled in Guardian insurance—but it offers limited customization, engagement, and legal depth.

For individuals and organizations seeking a dedicated, attorney-backed estate planning solution with modern user experience, measurable impact, and long-term support, Trust & Will is the stronger choice.

At Trust & Will, we’re here to help keep things simple. You can create a fully customizable, state-specific estate plan from the comfort of your own home. Take our free quiz to see where you should get started, or compare our different estate planning and settlement options today!

Is there a question here we didn’t answer? Browse more topics in our learn center, visit our Frequently Asked Questions (FAQ) page, or chat with our member support!

Trust & Will is an online service providing legal forms and information. We are not a law firm and we do not provide legal advice.

Last updated: December 17, 2025